It used to be easy – businesses had employees to carry out the day-to-day tasks necessary to run their business, and engaged contractors for particular projects, from premises refurbishment to advising on new business opportunities.

That has all changed – from “traditional” employers such a Deloitte or Coca-Cola, through technology leaders such as Atlassian to gig economy players like Uber, Airtasker and Deliveroo, jobs once carried out by employees are to a greater or lesser extent outsourced to contractors.

The growth of hybrid work arrangements has made the task of distinguishing between employees and contractors increasingly difficult – and raises a question of whether it even makes sense to categorise workplace arrangements on this basis. However, the law continues to do so, which makes it important to understand the difference. A misclassification can result in significant consequences for employers, such as underpayment claims, superannuation liabilities and penalties for breaching workplace laws under the Fair Work Act.

The Test

In 2024, following a couple of High Court decisions that it did not particularly like, the Albanese Government amended the Fair Work Act to establish an expanded statutory test for determining whether a worker is an employee or independent contractor. Under this test, “whether an individual is an employee of a person within the ordinary meaning of that expression … is to be determined by ascertaining the real substance, practical reality and true nature of the relationship between the individual and the person”.

However, the Act does not go the further step of specifically defining “employee” (let alone “contractor”), instead telling us that “employee and employer have their ordinary meanings” – which is not very helpful. The various taxation Acts also avoid defining these terms, relying on common law definitions, established by the decisions of the courts over many years.

So, what are these “ordinary meanings”?

Independent Contractor VS Employee

The ordinary meaning is summarised in a 2023 Tax Ruling from the ATO:

“At its core, the distinction between an employee and an independent contractor is that:

- an employee serves in the business of an employer, performing their work as a part of that business

- an independent contractor provides services to a principal’s business, but the contractor does so in furthering their own business enterprise; they carry out the work as principal of their own business, not part of another.”

An employee is a person hired to work for an employer, performing tasks under the employer’s direction and control in exchange for a wage or salary. They are entitled to benefits such as paid leave, superannuation and protection from unfair dismissal.

Independent contractors work for themselves by providing services to another person or business and will normally be registered with an ABN. They usually negotiate their own fees and working arrangements and can work for more than one client at a time. Independent contractors do not have the same entitlements and obligations as employees and generally manage their own entitlements and tax obligations.

That seems straightforward, but in its practical application it can be anything but straightforward. Holding an ABN does not automatically mean that someone is a contractor, whilst in some situations someone performing the identical duties to those of of an employee can still be a contractor. It all comes back to that “real substance, practical reality and true nature” test.

Where to start?

The starting point when determining if someone is an employee or contractor is the contract between the parties. It is always important for businesses to use correctly drafted written agreements when engaging workers, but it is absolutely crucial if the person in question is to be engaged as an independent contractor.

That is just the start – the terms of the written contract must then be followed through in the performance of the contract by both parties, in practice – it is both the written contract and how it is carried out that establish the true nature of the relationship in its totality.

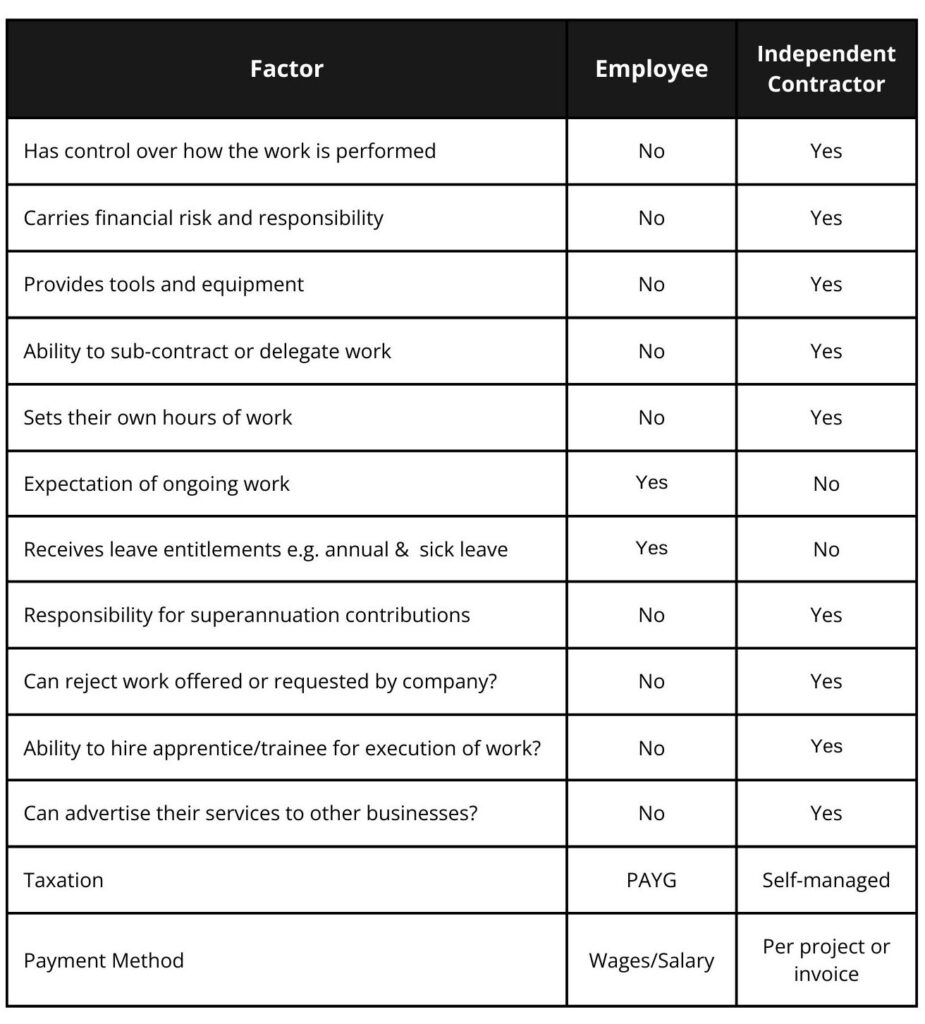

In determining the totality of the relationship, relevant factors include:

- the nature of the work conducted;

- the level of autonomy provided;

- the remuneration payment method;

- who controls how the work is done including delegating/sub-contract;

- who sets the hours of work;

- who carries financial responsibility and risk;

- who provides the tools and equipment; and

- what is the expectation around ongoing work.

If, despite the terms of the written contract, in practice the relationship looks and operates as one of employment, it will be treated accordingly by the courts and government authorities. As one eminent judge said in relation to this area of the law, “one cannot create something which has every feature of a rooster, but call it a duck and insist that everybody else recognise it as a duck”.

Mistakenly classifying an employee as a contractor can attract numerous employment liabilities including annual and personal leave, award rates of pay, penalties and loadings amongst others. It may also give rise to claims of sham contracting and further penalties.

What are sham contracts?

Sham contracts arise where what is in reality an employment relationship is dressed up to look like an independent contract. Sometimes this is done at the initiative of the employer, seeking to evade liability for employee entitlements and on-costs such as workers compensation insurance. In other situations the worker insists on being treated as a “contractor”, in order to claim business tax deductions and achieve other business-related benefits.

However, if the characterisation as a contractor is not genuine, it is invariably the employer who pays the penalty, including making up unpaid entitlements and award loadings, paying unpaid PAYG tax and potentially fines for breaches of employment and tax laws.

If an employer claims that the incorrect categorisation as an independent contract was unintentional, the onus is on the employer to prove that to have been the case.

Differences between employees and contractors?

Listed below are some of the more common differences that are taken into consideration when determining if an individual is an independent contractor or employee:

High Income Contractor Threshold

An individual who earns more than the contractor high income threshold (which is $183,100 as of 1 July 2025) can effectively “opt out” of the provisions dealing with the definition of employment. This means they and the business can choose to treat the relationship as one of independent contractor, without the risk of it being deemed an employment relationship.

If there is a change of mind or circumstance, a worker can withdraw an opt out notice via written notification (this is limited to one “opt out” notice per relationship). Conversely, a business can notify a worker that it “opts out” if it considers the individual may be an employee or earns more than the high-income contractor threshold.

How to minimise the risk for your business

Misclassification of a worker as a contractor, when in reality he or she is an employee, can result in severe penalties such as back-payment of wages, leave entitlements and superannuation, ATO penalties, insurance issues as well as exposure to civil penalties.

To minimise the risk of misclassification, employers should implement internal processes to maintain compliant work relationships such as:

- Assess each working relationship in its totality (contract terms + fulfillment of duties);

- Avoid standard contract templates that do not represent the true nature of the working relationship;

- Regularly review work arrangements, especially as roles evolve; and

- Document worker expectations and responsibilities clearly in contracts and internal communications.

If there is any doubt as to whether a worker is an employee or a contractor, seek expert legal advice – the consequences of getting it wrong are too severe. If you would like some guidance, simply contact our team – we’re here to help.